In U.S. presidential elections, the candidates’ respective tax plans continue to be a pivotal issue. For many, the direction of tax policy and the portion of American society that is targeted are key barometers for whether the country is moving in the right direction politically and economically, with Democratic administrations typically associated with higher taxation and Republicans typically associated with lower taxation.

While there are underlying debates that are challenging to succinctly answer — such as about the long-run effects of taxation and government spending on economic growth — voters deserve a clear picture of each candidate’s tax plans and how those issues may most directly affect average Americans, the wealthy, and American business.

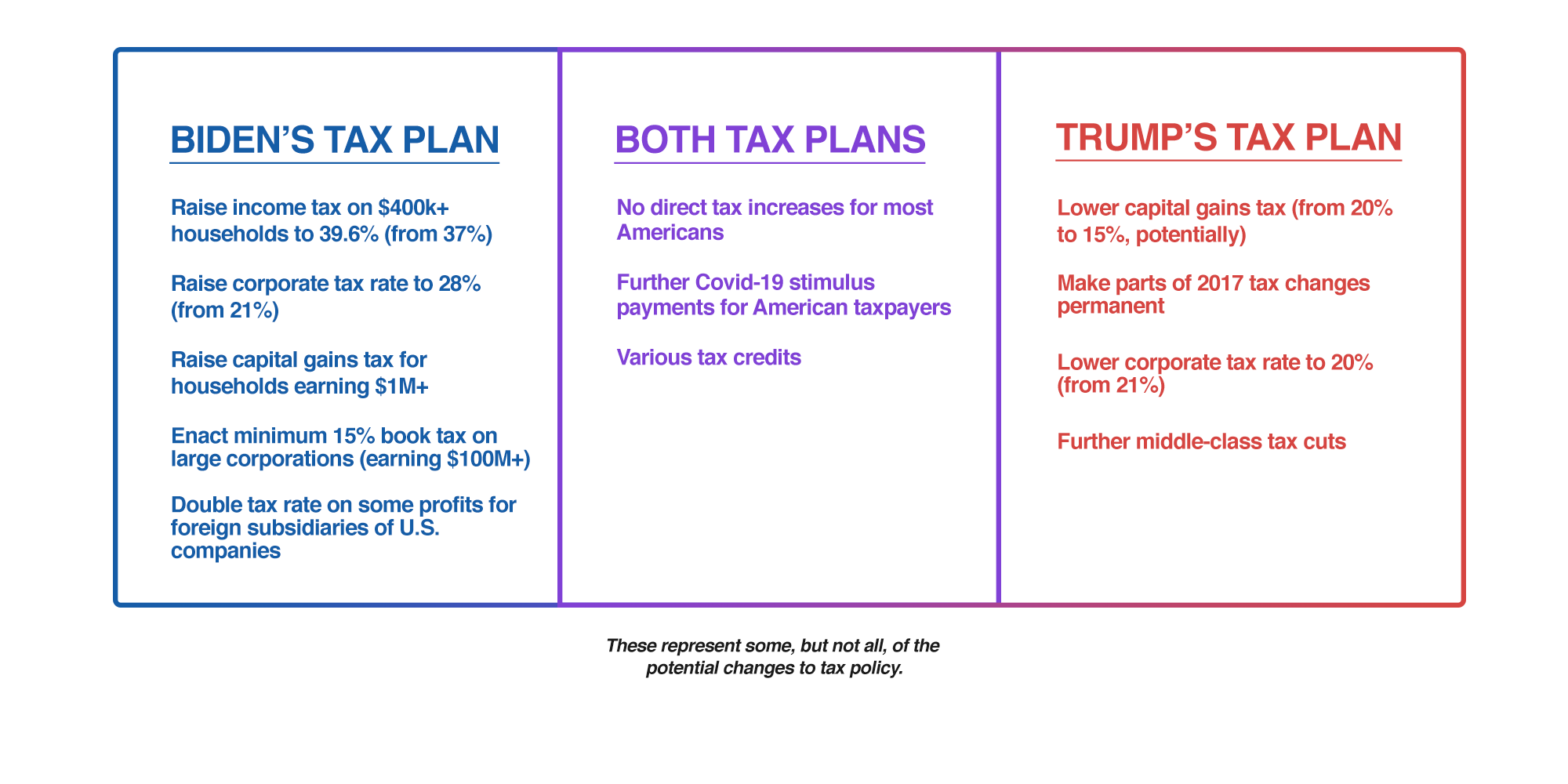

This week’s analysis from the Factual, relying on 28 articles from 17 sources across the political spectrum, reveals largely divergent tax plans. However, neither candidate’s plan results in income tax changes for most Americans, though there is some debate about how tax policy as a whole may lead to further costs or benefits for voters. Below are top-line summaries of each candidate’s plan and a discussion of their potential impacts on three key groups.

The Plans

Trump’s Tax Plan

As many point out, President Trump’s tax objectives for a second administration are vague, at least partially because he was already able to enact desired changes during his first term. There is not much onus on an incumbent to define a plan if desired policies are already in place. The bulk of these changes came through the 2017 Tax Cuts and Jobs Act (TCJA), which lowered taxes for roughly 65% of Americans and cut the corporate tax rate from 35% to 21%, bringing the latter more in line with global averages, among other changes.

“A reelected President Trump is expected to try to extend the effects of the [TCJA], and that may well constitute the bulk of his tax policy.” – Reason

A second Trump administration would seem to portend more of the same, including potentially lowering tax rates further for middle-class Americans by an unspecified amount, reducing the capital gains tax, making parts of the TCJA permanent that are set to expire in coming years, and further lowering the corporate tax rate to 20%. Beyond these major points, President Trump has also supported further stimulus checks for Americans (and to turn pandemic-related payroll tax deferments into tax cuts); expanding Opportunity Zones; and a series of positive-sounding, if undefined, tax breaks for businesses.

Source: Tax Foundation

Joe Biden’s Tax Plan

Joe Biden’s proposed tax policies aim to raise taxes for individuals whose income is above $400,000 per year, specifically by increasing the marginal tax rate for this group from 37% to 39.6%. In addition, Biden plans to increase the corporate tax rate from 21% to 28%, lower than the 35% seen during the Obama administration. Biden also plans to double the tax rate on profits for foreign subsidiaries of U.S. firms (Global Intangible Low-Taxed Income, or GILTI) and enact a minimum tax of 15% on the income that gets publicly reported to investors and shareholders for companies earning $100 million or more annually. These measures would collectively represent the fifth-largest increase in federal revenue collection out of 21 major tax bills since 1940, given the context that Trump significantly lowered taxes in 2017 (see graph above).

“Mr. Biden and his advisers say tax increases now would accelerate growth by funding a stream of spending proposals that would help the economy, like infrastructure improvement and investments in clean energy.” – New York Times

Beyond these broad measures, Biden’s plans include a number of tax credits meant to benefit specific groups and ends, such as the elderly and their caretakers, disabled persons and businesses that hire disabled workers, affordable housing, and climate-specific goals, including electric vehicles, energy efficient homes and buildings, and carbon capture and storage. Biden, like Trump, is likely to encourage pandemic-related stimulus payments directly to Americans.

These are brief summaries of the major points within each candidate’s tax plan. For more in-depth information, consider using this interactive tool from the Tax Policy Center, this series on Trump and Biden from Kiplinger (a business and finance forecaster), or this comparison from MarketWatch. Many other articles cited in our analysis offer additional context.

Please check your email for instructions to ensure that the newsletter arrives in your inbox tomorrow.

The Impacts

Average Americans

Above all, the outlook for taxation for average Americans — defined here as those who earn less than $400,000 annually — will remain pretty much the same, regardless of who wins (though the wealthier end of that spectrum will be more likely to feel the effects of potential changes to elements like capital gains). This reflects that Trump has already enacted many of the policies that Republicans desire and that Democrats would be wary of raising taxes on working families at a time of economic hardship.

With the TCJA already in place, a second Trump administration would generally seek to make those changes permanent or enact further tax reductions for the middle class. But Trump needs an amenable Congress to do so. This may be difficult given forecasts that give the Democrats a decent chance of winning both the House and Senate.

Biden’s plan, despite all of its changes, would not see direct alterations to the tax rates for individuals earning less than $400,000 annually — for context, that works out to about 98% of Americans. However, critics have argued that some of Biden’s other changes, such as higher corporate taxes or carbon taxes, could indirectly translate into greater costs for working-class Americans. Such analyses have found these potential costs to be relatively small — between 0.2% and 0.6% of after-tax income — while others argue that such costs would be offset by increased government spending.

A rare place of agreement between the two is in the need for further direct stimulus payments to Americans. Politically speaking, this should strike the right chord with voters, since more Americans are likely preoccupied with the immediate pains of the Covid-19 crisis than are concerned with the potential long-term fiscal impacts of further deficit spending.

Source: Investopedia

Wealthy Americans

Quite differently, wealthy Americans — generally those earning more than $400,000 annually, for the purposes of this analysis — see two diverging paths between the two candidates, choices that reflect fundamental left-right disagreement over the role for taxation. A Trump victory would likely mean further tax relief for the rich, whereas Biden “asks everyone to pay their fair share,” particularly because of the uneven recovery from the pandemic.

Having lowered tax rates for roughly 65% of Americans through the TCJA, Trump has some plans that may further benefit the wealthy. For one, he has targeted reducing the capital gains tax from 20% to 15%, meaning profits generated from assets such as stocks, bonds, and real estate would be taxed less, a change that largely benefits rich households. Wealthier households are not only more likely to own such assets, but the value of the assets owned increases rapidly the farther up the income scale a household is (see graphs below). Elsewhere, Trump has broadly suggested expanding Opportunity Zones, a program that offers incentives for investments in low-income communities, which applies to investors who have “a high net worth, a minimum annual income, and at least a six-figure investment.” Beyond that, there’s not too much detail, but Trump’s approach generally aligns with the conservative notion that successful individuals and investment drive economic growth and that taxation of the rich can inhibit said growth by moving resources from the free market.

Note: This graph demonstrates two points: (1) higher-income groups are much more likely to own stocks; and (2) the value of those stocks increases rapidly toward the high end of the income scale.

Source: Federal Reserve

Biden’s tax plan takes a different approach, returning the top tax rate to 39.6% from the 37% established by the TCJA (though these changes would only apply to households earning $400,000 or more), among other changes that will directly affect the richest Americans. For example, Biden seeks to cap itemized deductions for higher marginal tax brackets at 28% and to raise tax rates on capital gains, making taxpayers who earn over $1 million pay the full 39.6% on capital gains, rather than the current tiered system that maxes out at 20%. Elsewhere, Biden aims to return the estate tax exemptions to their pre-TCJA level — this means only the first $5.49 million of an estate would be exempt from the estate tax (paid during the transfer of wealth following a death) rather than $11.58 million. Overarchingly, Biden and left-leaning interpretations have it that “raising taxes on the rich to fund government spending that bolsters the productivity of the United States economy will accelerate economic growth.” Indeed, the prospect of a Biden victory has many wealthy families reorganizing their finances to mitigate these potential costs.

Businesses

Here too we see a large gap emerge between the competing tax plans, though those familiar with the left-right divide on taxation in America will doubtfully see anything too surprising. Trump will continue to make the case for lowered taxes on businesses and corporations, while Biden seeks for large corporations especially to bear the brunt of his plans to increase tax revenue.

Once again, it’s difficult to say too much about Trump’s tax plans for a new term, mostly because the suggested policies lack any significant detail at this point. Among other items, this potential list broadly includes “‘Made in America’ tax credits . . . [t]ax credits for companies that bring back jobs from China; 100% expensing deductions for essential industries like pharmaceuticals and robotics that bring manufacturing back to the U.S. . . . [and] [e]xtending business tax breaks in the TCJA.” That said, Trump’s tax approach has helped him win support among some small business owners; he has his strongest approval on economic issues due to “large tax breaks and deregulation for business owners and investors, and trade protection and aid for manufacturers, miners and farmers,” though that reputation has been complicated by the Covid-19 pandemic.

“The 2017 reduction in the corporate rate to 21% from 35% was the centerpiece of a plan that also lowered taxes for noncorporate businesses, estates and individuals. The business cuts did relatively little to boost investment, and raising the rate wouldn’t have a big impact either, said Owen Zidar, a Princeton University economics professor.” – Wall Street Journal

Biden, by comparison, wants to raise the corporate tax rate from 21% to 28% (below the 35% seen during the Obama administration) and enact others measures, such as a 15% minimum tax on global book income and a doubling of the tax on GILTI (certain profits earned by foreign subsidiaries of U.S. companies) to 21%. The measures collectively mean that many businesses could expect to pay more in a Biden presidency, which critics say will depress growth, albeit by small projected margins. However, other economists, including firms such as Moody’s Analytics, suggest that short-term costs will be offset by spending on “education, health care, child care and infrastructure—boosting worker productivity and economic growth in the long run.”

Note: These numbers reflect the average combined federal and state corporate taxes. In the U.S., the value 25.9% combines the federal rate (21%) with an average of additional state taxes (4.9%).

Source: Tax Policy Center

Please check your email for instructions to ensure that the newsletter arrives in your inbox tomorrow.

Americans’ Shared Future

There’s a much larger debate to be had about the relationship between taxation, government spending, and economic growth, but before we draw strong conclusions about what these potential changes mean, consider that “growth under Trump averaged 2.48% annually before the pandemic, only slightly better than the 2.41% gains achieved during Barack Obama’s second term,” when, for example, the corporate tax rate was 35%. Far from a signal for or against a specific taxation approach, it seems to offer an endorsement of the strength American economy as a whole, regardless of who is in power, or at least suggest that many factors beyond tax rates are responsible for determining economic growth.

And to be sure, neither plan is without its critics. While broadly aligned with traditional Republican policy goals, Trump has run up large deficits (even pre-pandemic) while simultaneously cutting taxes and ruling out changes to Social Security and Medicare, which leaves him at odds with traditional tenets of fiscal conservatism. While Biden’s policy plans attempt to pay for new spending, some question whether changes to tax policy too quickly or in the wrong places could slow or reverse a recovery from the worst effects of the Covid-19 pandemic. These are all valid concerns, but it’s hard to know which way tax policy will actually be travelling, and at what pace, until the results of the election on November 3 are known.

Appendix

This appendix shows each of the articles used to inform the findings of this article, as well as how the articles scored according to The Factual’s credibility algorithm. To learn more, read our How It Works page.