There are 600+ articles published every day on COVID-19, so it’s easy to be overwhelmed. Many of us are just scanning headlines to stay atop the news, and this doesn’t always translate into a representative picture of all the most important issues.

With that in mind, we want to take a step back to briefly analyze key aspects of the COVID-19 crisis such as government and politics, healthcare preparedness, economic impact, international response, and cultural influence. In this post we’ll look at the economic impact of COVID-19, summarizing the most widely reported story of the week, as well as an important perspective that only one or a few outlets were covering, so you get details beyond the headlines while still saving time.

Please check your email for instructions to ensure that the newsletter arrives in your inbox tomorrow.

Most Widely Reported Topic

Washington works on coronavirus stimulus, with Trump administration calling for $850 billion package

MarketWatch (Political lean: Center; The Factual’s credibility grade: 81%)

As U.S. markets recoil from a series of financial blows, the Trump administration continues to look for ways to reassure a panicking public and business environment. The rationale for a series of economic measures to combat the impacts of COVID-19 is that strategic injections of money into the economy can allay some of the worst economic impacts from the disease. The measures under consideration include direct transfers of cash to every American citizen (in an effort to spur consumption), a payroll tax cut, and bailouts for the hardest-hit industries.

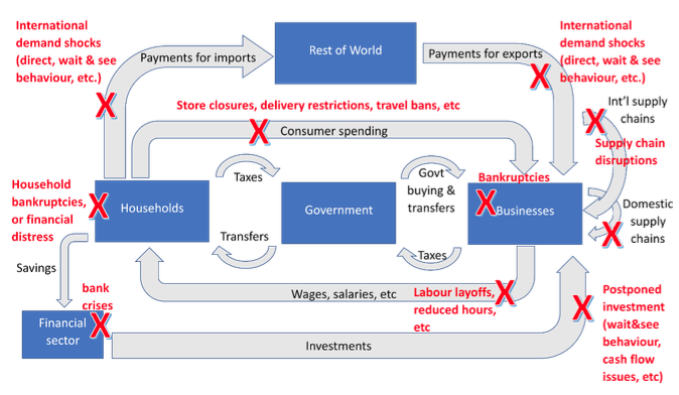

Source: Naked Capitalism

Source: Naked Capitalism

Such measures are imperative at this juncture, at home and abroad, as specific businesses and indeed entire sectors face the prospect of a near-total collapse in demand. In particular, many of the jobs attributed to the recent historic lows in unemployment — often part-time, service-oriented, and insecure — are expected to face lay-offs as business dries up, including millions of restaurant workers. These individuals will be sorely in need of financial relief as their income streams evaporate, expenditures continue, and job markets shrink. Hopeful eyes are now trained on the Senate, with the impending stimulus package being a sorely needed, if likely insufficient, respite from the ongoing crisis.

Under-Reported Topic

Coronavirus Means Zero Hour for the European Union

Naked Capitalism (Political lean: Moderate Left; The Factual’s credibility grade: 81%)

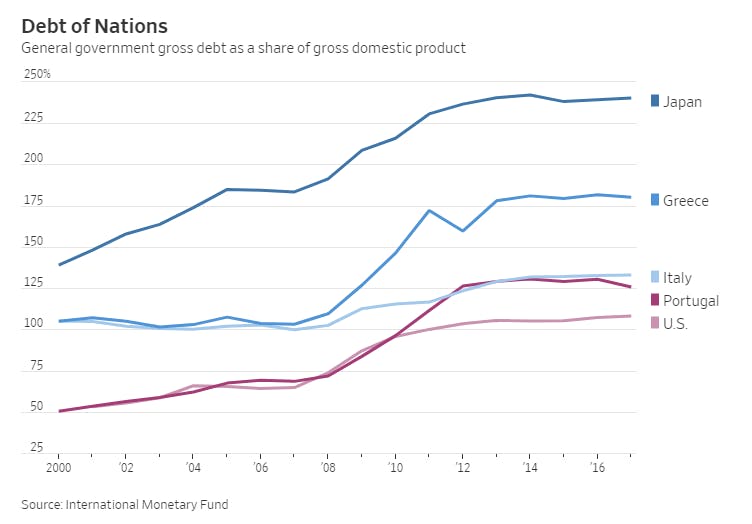

A story that has perhaps gone under the radar amid historic losses in the stock market and ruptures in energy markets is that the European Central Bank (ECB) has signaled a level of unwillingness to offer extra support to Italy and other countries still burdened from debt from the global financial crisis (GFC) but which need to spend money (similar to the the U.S.) to offset the effects of COVID-19. While the fiscally-challenged members of the EU have been given some minimal extra room to spend, their tools and abilities are greatly reduced vis-a-vis European powerhouses such as Germany.

In the short term, the rules of the Eurozone mean Italy simply cannot spend as readily as may be needed to stave off the worst of COVID-19’s economic impact, particularly in terms of lending to businesses. In the long run, critics see an unsustainable cycle, where southern European economies already saddled with debt from the GFC face the prospect of unending austerity and onerous fiscal rules from the Eurozone’s richer partners.

Please check your email for instructions to ensure that the newsletter arrives in your inbox tomorrow.

Even before the crisis, Italy’s debt-to-GDP ratio was above 140%; for reference, France, Germany, and the UK all have debt-to-GDP ratios below 100%, and the World Bank warns that as ratios increase, specifically above 77%, so does the risk of debt default. Worryingly, Christine Lagarde, the ECB’s boss, has now suggested that the bank “is not here to close spreads,” signaling an unwillingness to help Italy reduce its financial risk. As the article suggests, the ECB needs to prop up the worst affected countries without indefinitely prolonging this debt dynamic. Otherwise, there is increasing risk that economic hardship in Italy becomes a macroeconomic crisis — or something even worse.

For daily updates on coronavirus and the world’s most important news topics, subscribe to our newsletter. For the best coverage of coronavirus every hour, on the hour, try our coronavirus timeline. And to anyone else in lockdown, keep calm and carry on!